Capital structure shows the ways and means of financing the fund requirements of an organization and the capital can be funded mainly through two ways. They are;

- Equity capital and

- The debt capital

In relation to capital structure, there are two important questions and they are as follows.

- The goal of the shareholders’ is always inlying with maximizing the firm value and the first important question under capital structure is linked with this. That is, why should the shareholders worry about maximizing the firm value instead of worrying about maximizing the shareholder value?

- What is the ideal debt to equity ratio that a company is supposed to maintain which in turn maximize the shareholders’ value?

Here the main point that we need to know is; the changes in the capital structure benefits shareholders, only when the firm value increases.

Under this article, we are going to learn the following 4 main theories.

- Relevant theory

- Irrelevant theory

- Traditional theory

- Modigliani and Miller (M&M) theory

And these theories have been developed based on several assumptions.

- Firms’ funding requirements are funded through two types of ways. They are perceptual riskless debt and equity.

- No corporate, income or personal tax.

- No retained earnings. ( i.e. dividend payout ratio is 100%)

- The amount of total assets of the firm is given and they do not change.

- Total capital of the firm is assumed to remain constant. (i.e. Though the composition of the capital changes the amount of capital remain constant over the time)

- EBIT of the firm is also expected to remain constant.

- Business risk is also constant.

- The firm has a perpetual life.

Based on the above assumptions let’s try to talk about the above-mentioned theories in detail.

1. Relevant theory

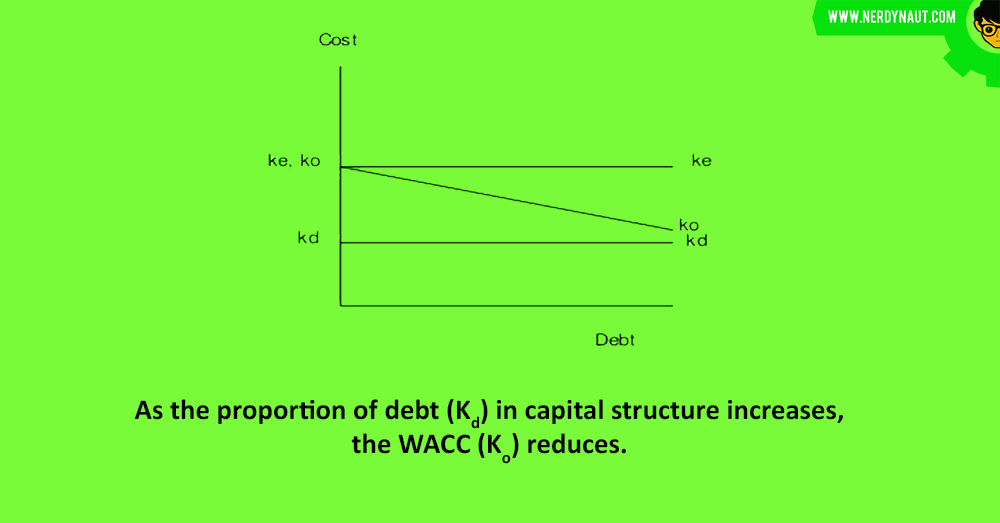

This relevant theory tells that the composition of the capital has an impact on the value of the firm. Before looking at how it happens let’s have an idea about the assumptions on which the relevant theory is built. So that you all can easily identify how it happens.

- Both the cost of debt and the cost of equity remains unchanged.

- The cost of debt is always less than the cost of equity.

- No corporate income taxes.

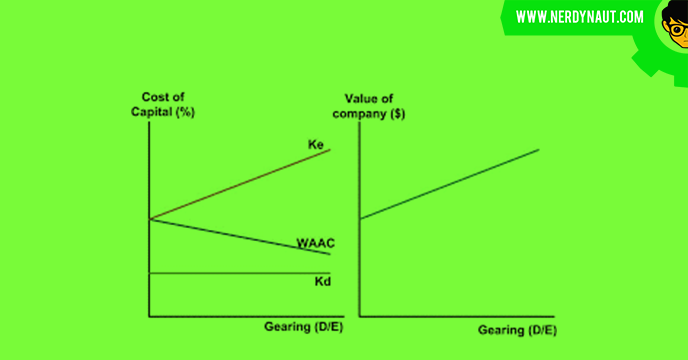

Based on the above assumptions; when increasing the debt capital or in other words when increasing the financial leverage of a company when the cost of debt is less than the cost of equity it is clear that the overall cost of capital will decline. That is what happens behind this theory and the following graph will clearly show you what it really is.

2. Irrelevant theory

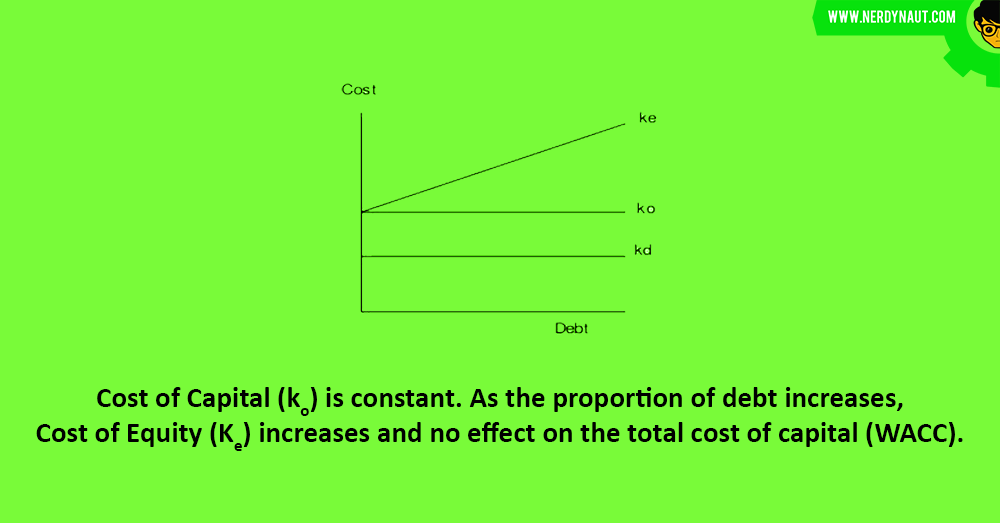

In the previous theory, it said that there is a relationship between the capital structure and the value of the firm. But here this says the exact opposite thing. This says that there is no relationship between the capital structure and the value of the firm.

Here it assumes that, as the borrowings increases the shareholders will be at a risk and hence they will expect a higher return as the debt portion in the capital structure increases. And this will nullify the benefit that can be gained through the lesser amount of cost of debt. Therefore the capital structure will not affect on the value of the firm.

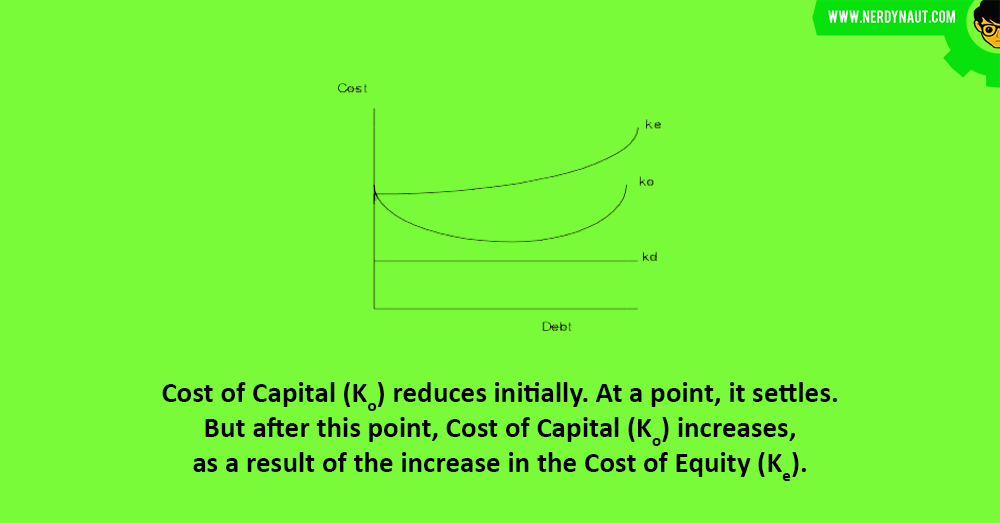

3. Traditional theory

When it comes to the traditional theory there are mainly three stages in relation to the relationship between the financial leverage, overall cost of capital and the value of the firm.

Initially, the value of the firm increases as a result of the overall cost of capital reduces while the financial leverage is increasing.

But after a certain point, this reduction in the cost of capital stabilizes and that point is known as the judicial level debt capital.

But after the judicial level of debt capital, the further increase in borrowings in the capital structure will eventually increase the financial risk of the shareholders and this will result an increase in the cost of equity. Here the cost of debt also increases due to the bankruptcy costs and ultimately this will lead the overall cost of capital to increase and the value of the firm to reduce.

4. M&M theory

This theory has been developed on several assumptions and they are as follows.

- Homogeneous expectations

- Homogeneous business risk classes

- Perpetual cash flows

- Perfect capital markets

- Perfect competition

- Firms and investors can borrow or lend at the same rate

- Equal access to all relevant information

- No transaction costs

- No taxes

Under this theory, we need to look at the value of the firm in two scenarios. When the taxes are in operation and when the taxes are not in operation, the value of the firm is affected in two ways. So under this theory, we need to know how the value of the firm is affected under each situation.

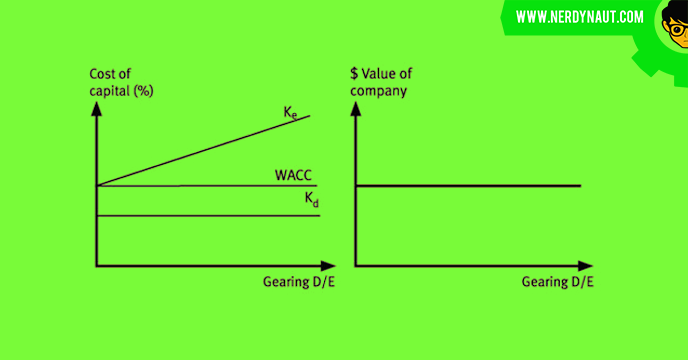

4.1 Without taxes

under the M&M theory (without taxes) the value of the firm does not change as the financial leverage increases since the WACC does not change. And this graph shows how this theory works.

4.3 With taxes

Under the M&M theory (with Taxes) the capital structure affects on the value of the firm. Because when the financial leverage increases the cost of equity also increases while the cost of debt remains unchanged. Here since the interest paid on debt is tax deductible this tax benefit will lead the overall cost of capital to be reduced even though the cost of equity increases. As a result of this WACC decreases and hence the value of the firm increases as a result of that.

Conclusion

In this article, we mainly discussed 4 theories.

In relevant theory, it said that the capital structure decisions are relevant where as in the irrelevant theory the capital structure decisions were not relevant. And in the traditional theory, it was a combination of both the relevant and irrelevant theories. Finally, in the M&M theory, there were two situations where the capital structure was relevant given the taxes are in operations while the capital structure was not relevant given the taxes are not in operations.